Some posts on this site contain affiliate links, meaning if you book or buy something through one of these links, I may earn a small commission (at no additional cost to you!). Read the full disclosure policy here.

It’s time to start considering how to bring down the costs of flying around the world (or splurge on business class!). Travel hacking, or the opening of credit cards for extra sign-up airline mile bonuses, is basically the extreme couponing of travel. And just like extreme couponing, it can save you thousands of dollars!

However, unlike extreme couponing, if you’re not careful, it can completely ruin your credit. While risky, if you travel hack responsibly, and follow these rules, not only will you probably have better credit than when you started, but tons of almost free travels ahead of you! Read more and have travel hacking success today!

1. Know Your Credit

This is first because it is the most important: your credit score. Whether you’d like all the travel cards you can handle, or you’re applying for a mortgage on your first home, good credit is a necessity. But before you even think about applying for a credit card, you should know this number.

I use Credit Karma to keep track of my score, which updates me when there are changes to it. It doesn’t ding your credit to check this app, and I feel confident in my score as it is being pulled from two sources, TransUnion and Equifax. So the first thing you should do is download this app and see where you stand. Also, you should look at your free credit report each year for any changes. If you see something unusual on your credit report, you should contact the credit reporting agencies to get it resolved and get your score back up.

Travel rewards cards typically require pretty robust credit scores to be considered. I would recommend at the very minimum to have a score of at least 720. And with credit scores, the higher the better. I’d opt for a 740 or higher before applying for more premium credit cards like the Chase Sapphire Reserve.

2. Go Slowly

I know how exciting free travel sounds, and the first time I heard about this, I wanted to apply for everything. However, creditors see this as extremely risky, and applying for too many cards at once will likely warrant a rejected application. Remember, travel hacking is a marathon, not a sprint. You need to start slowly here.

While opening 2-3 cards was a popular thing to do years ago, now banks have caught on, and I only really recommend opening one card at a time and taking time between opening new cards.

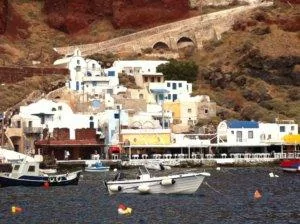

Use miles to fly to the lovely island of Santorini.

3. Open New Cards From the Same Bank 91 Days After Your Previous Card

Not to keep repeating this mantra, but opening several credit cards in a short period of time is obviously risky to banks. Also, you’ll probably receive hard inquiries on your credit from the credit card applications you apply for. These will temporarily decrease your score, usually for about 3 months, but it will typically return to normal after that. The inquiries will drop off your credit completely within 2 years, but the effects go away within 90 days.

So waiting 91 days between opening cards is always your best bet. Wait for your credit score to rise back to normal, and then apply for new cards. And if you want to get cards from the same bank waiting 91 days is essential to avoid them flagging your account for fraud or closing your account altogether (especially if you already have cards with them).

Also, as many cards have minimum spends to get their high sign-up bonus, usually due within three months of opening the card, you want time to hit those minimum spends before opening up new ones. These minimum spends can range anywhere from $500 to $5,000 in three months, so making sure you can hit those is definitely key. Otherwise, you don’t get the bonus miles and it’s completely worthless.

4. Spend Only What You Can Afford/Pay Off Monthly

This should be obvious, but you should pay off your card each month in full. Travel rewards cards tend to charge higher interest rates, so paying it in full will prevent this in the first place. Also, not paying off your card will cause your utilization rate, or the balances on your cards over your total available credit, to increase. As you’ll want to keep that below 4%, paying off these balances will only help your credit.

And again, with minimum spending requirements, make sure you can meet these via either everyday spending (bills, entertainment, etc.), manufactured spending (paying for dinner for the table and having them Venmo you, send money via Venmo to a trusted person and they pay you back, etc.), or purchases you’ve saved for (wedding/honeymoon deposits, etc.). Do not spend money just to hit the minimum spend: that’s a likely way to overspend and go into debt. Just spend your normal, budgeted monthly amount, and apply for cards you can afford. Don’t apply to cards with $4,000 minimum spend requirements unless you can spend that amount normally and pay it off.

But on the bright side, if you’re planning a wedding and have saved up the money, put those deposits/final payments down on the card and pay it off! It may be the easiest way to hit those minimum spends without trying.

5. Chase 5/24 Rule

Now I’d like to discuss certain rules credit card companies individually have if you want to collect cards from them. The first one is Chase. Chase Ultimate Rewards is one of the best airline travel rewards systems out there by far. Their sign-up bonuses are great, and they have amazing credit cards. The downside, however, is you can’t apply for cards with them if you’ve opened up 5 credit cards (from any bank) in the last 24 months.

They also have a rule where you can only have one Sapphire card at a time. So if you open up the Preferred, you can’t have the Reserve at the same time and vice versa. You also can’t have received the sign-up bonus from one of these cards within the last 48 months if you hope to open the other if you’ve closed one.

So for Chase cards, you need a little strategy of when to open these.

6. Citi Rules for American Airlines Advantage Cards

While you can get the AA Advantage Gold, AA Advantage Platinum, and the AA Advantage Executive cards, you will not receive the sign-up bonus for all three. They have a rule where you can only receive a sign-up bonus on the first one you open. You can, however, close whichever AA Advantage card you get and open another in 48 months and get the bonus, but not before.

My strategy here would be to obviously just open one card, but pick the card with the highest bonus. The AA Advantage Executive is the premium card that has a higher annual fee but some more perks. If that looks worth it to you, then open that. If the annual fee of $450 is a bit steep, I’d go with the better bonus of the Gold and Platinum.

7. Things to Note: Amex Bonuses

American Express points are divine. They transfer to so many airline partners, typically with a 1:1 ratio. Meaning your points equal miles. Some of their 1:1 transfer partners include Delta, JetBlue, Singapore Airlines, Air France/KLM, Air Canada, and so many more.

Amex also has co-branded cards with Delta, Marriott, and Hilton Honors. While they usually have decent sign-up bonuses, once you get this sign-up bonus, you can never get it again.

Most banks, like Chase and Citi, allow you to close your card and you can receive the sign-up bonus again if you apply 48 months later. Sadly, Amex does not do this, so keep this in mind when figuring out which cards to get.

8. If You Get a Pending or Denied Application, All is Not Lost!

I’ve experienced the nerves that come with a pending review application. I hadn’t opened up many cards at this point so I was worried if I’d screwed it all up. Luckily, each bank has a reconsideration line, which I called. It turned out that they were missing some information, which I supplied and boom! Approved over the phone.

I’ve known many people get denied cards because the bank feels that they have too much credit available on their other cards. All you simply have to do is decrease your credit on a card and you can be approved for the new one.

Basically, all is not lost. If your application is denied, or pending a review, simply call the reconsideration line. It won’t guarantee an accepted application (especially if you’ve applied for a Chase card post hitting your 5/24), but it could lead to an acceptance. A lot of the time a pending or denial could be due to missing information, needing to lower your other card credit lines, etc. Don’t give up getting the card before calling. And if you do get rejected, only the hard inquiry will ding your credit score temporarily, not the rejection.

Always wanted to go to a far-flung location like Cape Town? By travel hacking, it’s entirely possible for cheap!

9. Knowing When to Close

You’ve probably heard that closing a credit card is the worst thing you can do. That it’ll hurt your credit. Besides reading up on how your credit score works, know that while closing a card could impact your credit, it also may not.

For instance, I have a no fee card with US Bank that I’ve had for years. It’s my oldest line of credit. Would I ever close that? Absolutely not. It keeps my overall credit age older, and makes me look like a better person to give credit to. Now my Delta Gold Amex that is almost a year old? I may consider dropping that so I don’t have to pay the annual fee. As it’s a younger card, it won’t affect my overall age of credit much. However, it will affect my utilization rate, as that will lower my available credit, making my amount of credit used look larger. But as I pay off my card each month, my utilization rate is usually 1% or less, meaning closing this account won’t really affect my credit.

The trick here is not to close these accounts right after you get the bonus. Banks notice this and will probably reject you should you apply for another card with them. The best bet is to keep the card until before the annual fee is due, and then either call and convince them to waive the fee or give you something in return for the fee (extra miles, companion pass, etc.), downgrade your card to a no fee card they have, or close the card. Banks want your business, so you may be able to convince them to negotiate the fee or downgrade your card. It’s worth a shot, right?

10. Can You Get a Business Card?

I know, you’re probably thinking that you definitely don’t own a business. But that is where you could be wrong with business credit cards. Maybe you coach a little league team and earn a couple hundred dollars from it. Maybe you sell a few things on Etsy every once in a while. Heck, even a garage sale could count. Or maybe you’re actually creating a business like myself. The applications will let you put your social security in rather than a business ID and you will be considered a sole proprietor. This then opens up a whole range of cards you can get!

Have you started travel hacking yet? Which card is your favorite? Which rule is the most helpful to you? Let me know in the comments!

Start travel hacking today!

The Perfect Wedding Planning Travel Hacking Guide - World Wide Honeymoon

Thursday 9th of January 2020

[…] important to note that Chase Ultimate Rewards cards now fall into Chase’s dreaded 5/24 rule. This means that if you’ve opened up more than 5 credit cards within the last 24 months, you’re […]

How to Save Over $25,000 in Travel in 2 Years - World Wide Honeymoon

Wednesday 28th of August 2019

[…] 10 Rules for Travel Hacking Success […]

Don’t Quit Your Job, Buy That Ticket, and Just Go… 5 Things to Save Money For (Other Than Travel) - World Wide Honeymoon

Monday 19th of August 2019

[…] And I’m not just talking about student loan debt here. I’m also talking about credit cards and any other debt. I’ve always been big on paying off credit cards since I hit my mid-twenties and realized that the interest is insane! And if I wanted to get into the travel hacking game, I needed to get used to paying it off every mon…. […]

Navigating the Chase 5/24 Rule - World Wide Honeymoon

Wednesday 2nd of January 2019

[…] it comes to travel hacking, there are always certain rules you need to know to prevent as little card rejections as possible and maximize your miles and points earnings. If you’ve been in the travel hacking game long […]

Anne Betts

Tuesday 9th of January 2018

Great tips, Kat. Your credit card examples are USA-specific, but your advice and tips are useful for readers from other countries. Useful information. Thank you.

Kat

Tuesday 9th of January 2018

Thank you Anne! Yea, travel hacking gets pretty complicated outside of the US. I’d like to write more about it later though! I hope the tips help!